Protecting Your Legacy for Future Generations

Every family carries a unique legacy, a tapestry woven with values, experiences, and the hope for a thriving future. Protecting this legacy, not just for the present but for generations to come, is a responsibility filled with purpose and love. This guide, your compass on this journey, aims to equip you with the knowledge and resources necessary to safeguard your legacy for years to come.

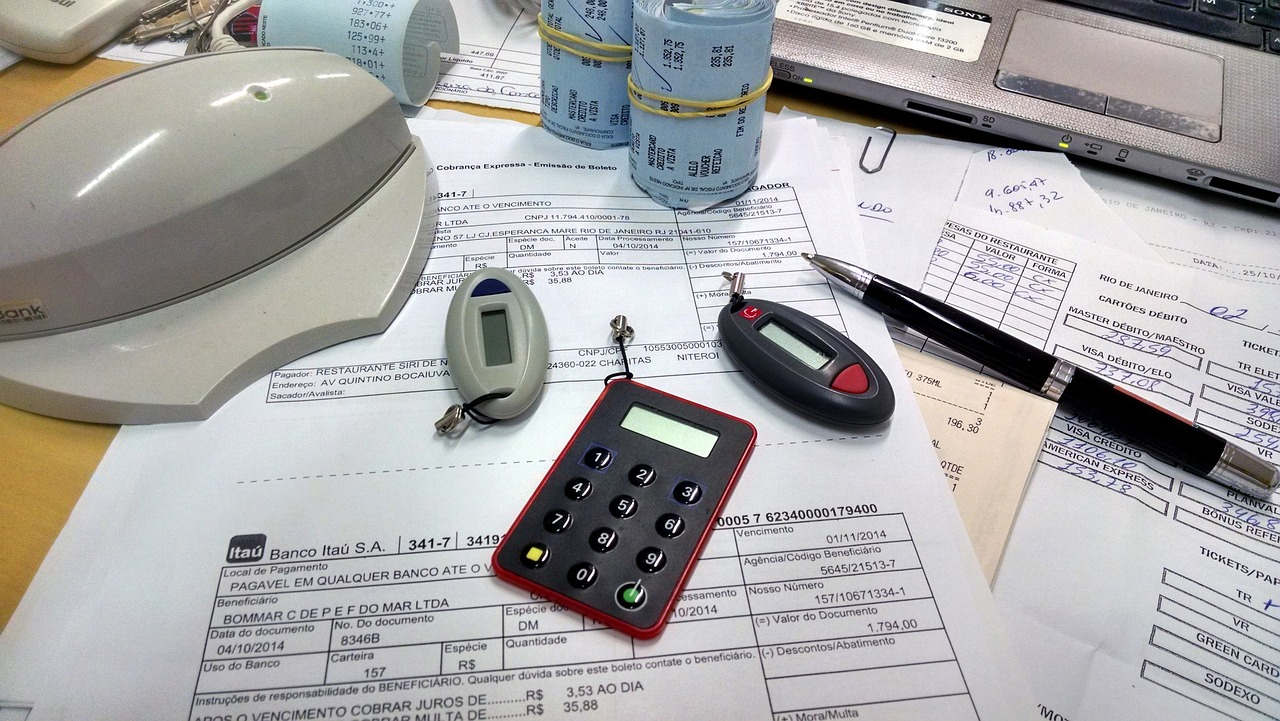

Laying the Cornerstone: Understanding Your Assets

Every legacy begins with a clear understanding of your wealth. This encompasses not just tangible assets like savings, investments, and property, but also intangible treasures like family heirlooms, educational opportunities, and even your own wisdom and skills. Taking inventory of your financial landscape is crucial. Consider seeking financial advice Huddersfield from experienced professionals who can map out your current situation and help you chart a secure path forward.

Solidifying the Base: Building a Financial Fortress

The bedrock of your legacy rests on a firm financial foundation. This involves tackling critical aspects like:

- Debt Management: Strategically managing existing debt prevents it from eroding future wealth. Consider debt consolidation strategies or exploring ways to increase income to expedite repayment.

- Tax Optimization: Navigating the complexities of the tax system can be daunting. Seeking professional guidance on utilizing tax-efficient strategies like ISAs and trusts can significantly boost the amount you leave for future generations.

- Investment Planning: Cultivating a diversified portfolio tailored to your risk tolerance and long-term goals is key to sustained financial growth. Consult with financial advisors to explore various investment options and build a plan that aligns with your family's aspirations.

- Retirement Planning: Ensuring your own financial security in retirement prevents becoming a burden on future generations. Develop a comprehensive retirement plan, considering factors like desired lifestyle, potential pension income, and potential healthcare needs.

Beyond Finance: Nurturing the Intangibles

While financial security is vital, a meaningful legacy transcends mere monetary value. Consider these additional steps to cultivate a lasting impact:

Passing Down Traditions and Values: Sharing treasured traditions, stories, and values through storytelling, rituals, and shared experiences builds a strong foundation for future generations. Create special traditions that embody your family's unique spirit and weave them into the fabric of everyday life.

Investing in Education: Equipping your children and grandchildren with educational opportunities opens doors to limitless possibilities. Consider setting up education funds, supporting after-school activities, or encouraging academic pursuits that ignite their passions.

Mentorship and Guidance: Your own experiences hold invaluable wisdom. By offering mentorship and guidance to younger generations, you bridge the gap between past and future, keeping family values alive and providing a vital support system.

Community Engagement: Fostering a sense of civic responsibility within your family encourages them to become active participants in shaping the future. Encourage volunteering, supporting local businesses, and engaging in community initiatives to leave a lasting mark.

Finding Your Guiding Hand: Navigating Your Legacy Journey

Building a legacy is a multifaceted journey, and seeking professional support can be invaluable. Numerous financial advisors offer comprehensive services to help you:

- Comprehensive Financial Planning: Analyse your current financial situation, formulate personalized strategies, and navigate the complexities of taxes, investments, and retirement planning.

- Tailored Advice: Understand your specific needs and goals, then craft a customized plan to protect and grow your wealth for future generations.

- Ongoing Support: From initial consultations to regular reviews and adjustments, financial advisors are your trusted partners every step of the way.

A Legacy of Love and Security: The Ultimate Reward

Protecting your legacy is not just about securing assets; it's about love, values, and creating opportunities for future generations to flourish. By taking these steps and seeking professional guidance, you can build a legacy that resonates through time, a tapestry woven with financial security, cherished traditions, and unwavering support. Remember, true wealth lies not only in material possessions but also in the love, knowledge, and opportunities you pass on to your loved ones. Let this guide be your compass as you embark on this rewarding journey, leaving a lasting mark on the world and beyond.

- Why Travertine From Turkey Is Considered the World’s Premium Choice

Turkish travertine has evolved into one of the most sought-after natural stones in global construction and design markets, admired for its refined aesthetic, structural durability, and exceptional versatility.Written on Tuesday, 09 December 2025 09:51 Be the first to comment! Read more...

Turkish travertine has evolved into one of the most sought-after natural stones in global construction and design markets, admired for its refined aesthetic, structural durability, and exceptional versatility.Written on Tuesday, 09 December 2025 09:51 Be the first to comment! Read more...- uPVC Windows: A Smart Upgrade for Warmer, Quieter and More Secure Homes

Written on Wednesday, 26 November 2025 08:12 Be the first to comment! Read more...

Thinking about replacing your old frames, but not sure if it’s really worth it? Modern uPVC Windows are one of the simplest ways to make your home warmer, quieter and more secure – while also improving kerb appeal and long-term property value.

- Orangery Ideas - A Quick Homeowner’s Guide to Design, Comfort and Permissions

Written on Wednesday, 26 November 2025 07:48 Be the first to comment! Read more...

Thinking about adding light, space and year-round comfort to your home? An orangery can feel like a true extension without losing the bright, glazed character people love. Here’s a short, practical guide to help you plan with confidence.

- The Hidden Advantages of Choosing an Outsourced NOC for Your IT Infrastructure

Written on Wednesday, 19 November 2025 15:03 Be the first to comment! Read more...

Managing a complex IT infrastructure is becoming increasingly demanding, especially for companies that are expanding or using diverse technologies. IT managers and business leaders are seeking modern solutions to maintain security, streamline processes, and control costs—without exhausting their internal teams.

- How to Prepare for Your Man and Van Service - A Moving Day Checklist

Written on Sunday, 09 November 2025 13:43 Be the first to comment! Read more...

Moving day can feel like a marathon — boxes everywhere, last-minute packing, and that constant fear of forgetting something important.

- High-quality California DTF transfers printing Written on Monday, 20 October 2025 15:12 Be the first to comment! Read more...

- How Creators Reducing Carbon Footprint Through Smart Automation

Written on Tuesday, 14 October 2025 12:05 Be the first to comment! Read more...

As environmental awareness grows among content creators, an unexpected solution has emerged for reducing digital carbon emissions: intelligent AI automation. Forward-thinking creators are discovering that smart technology choices can dramatically reduce their environmental impact while actually improving their content quality and audience relationships.

- Understanding Luxury Watch Quality- What Sets OMEGA and TAG Heuer Apart

Written on Thursday, 09 October 2025 14:00 Be the first to comment! Read more...

The luxury watch market offers countless options across various price points, making it challenging for newcomers to understand what actually justifies premium pricing. Two brands that consistently deliver exceptional value within their segments are OMEGA and TAG Heuer. Both Swiss manufacturers share commitment to quality whilst targeting slightly different audiences and price ranges.

- uPVC Windows: A Smart Upgrade for Warmer, Quieter and More Secure Homes